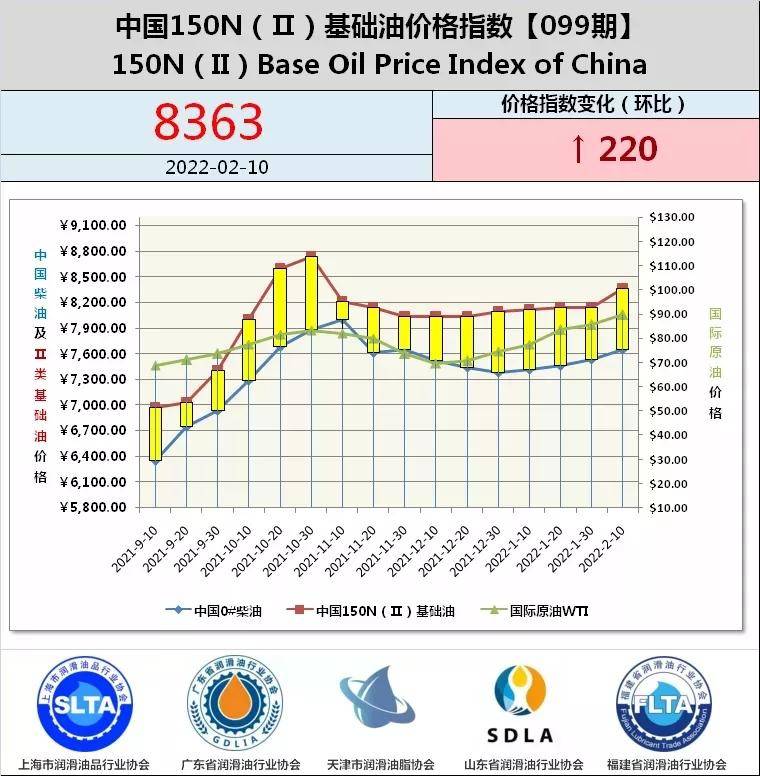

Deep analysis | Keep soaring? The rise or fall trend of prices of China's lubricating oil in the first half of 2022?

Publisher: Release date: reading:1460

Entering 2022, central banks of various countries have accelerated the pace of "increase in interest rate" under global inflation expectations; But under the tightening expectations,

there is a sustained rise in the price of crude oil, so lubricating oil manufacturers across the country face "an up sound".

For the future oil price trend in 2022, the oil price of many institutions is looking up!

01

Global oil inventory is the minimum in the last five years.

Global oil inventory declined sharply in 2021 and Amer's analysts predict that the oil inventory will be lower in 2022.

The OPEC mentioned in its report of December 2021 that commercial oil inventory of member countries in OECD decreased to 2.72 billion barrels by 31.2 million barrels from the last month.

That made the inventory decrease by 311 million barrels from December 2020 and less than 210 million barrels than the five-year average. The trend corresponds with weak global production and has pushed oil price to its highest level since the end of 2014.

02

Global oil production enters the low output stage

According to the OGJ data statistics of the BP Statistical Review of World Energy 2021, the global oil production generally tended to decrease from 2015 to 2021.

In 2020, global oil production fell by 5.3% from 2019 to 4.165 billion tons; Driven by a sharp rebound in oil and gas prices, there was a mild rally in global oil production in 2021 by 1.3% to 4.423 billion tons from 2020.

But entering 2022, influenced by still serious epidemic status, the global oil production drops from 6.5 million barrels/day at the beginning of 2021 to 3.4 million barrels/day.

Amer's analysts predict that global oil production will drop to below 2 million barrels per day.

03

The investment global oil industry is historically low

Under the goal of the International Energy Agency to achieve zero emissions by 2050, the investment in international crude oil has declined sharply,

but demands for international crude oil have no significant degradation.

Energy Intelligence predicts that the capitalization investment of the global oil industry will increase by 10% this year, reaching USD 420 billion.

However, when listed companies regard the return to shareholder as the first goal of oil companies, the global reinvestment rate, namely the proportion of capitalization investment to the current year's cash flow will remain at around historically low 40%.

Especially in case of shrinking spare production capacity of the OPEC+ (OPEC and its allies) and a sustained recovery in oil demand, the oil market is jittery that upstream investment is still lagging behind.

In the past two years, few listed companies were willing to approve new large-scale oil projects and capital investment in upstream business was mostly concentrated in short-cycle,

low-cost and low-carbon projects. This trend has already appeared before the COVID-19,

and the reason is that investors were fed up with capital inefficiency and lacked confidence in long-term demand in the oil market.

04

Rises on rising tensions over Ukraine lead to a rise in crude oil

On February 14, US Secretary of State Antony Blinken announced that he had ordered the closure of the U.S. embassy in Ukraine in Kyiv, the central city of Ukraine,

and "temporarily" transfered the few diplomatic personnel who stayed in Kyiv to Lviv, the western city of Ukraine. Blinken called on U.S. citizens in Ukraine to leave the country as soon as possible.

Affected by this, global crude oil surged, and WTI crude oil futures for March ended up 2.53% or USD 2.36, at USD 95.46/barrel;

Brent crude oil futures for April ended up USD 2.04, or 2.16%, at USD 96.48/barrel. The US said that Russia may take offensive military action at the earliest in the near future, as a result,

market concerns about tensions over Ukraine are intensified and international oil prices show significant advances.

05

The rise or fall trend of prices of China's lubricating oil in the first half of 2022

Inventory reduction, decline in production capacity, and low industry investment, as well the pandemic and the unstable situation in Ukraine,

will inevitably lead to instability of oil prices in the world and in China in 2022.

The base oil, as an auxiliary product from crude oil processing, needs to go through processes such as distillation, decolorization, and hydrogenation,

which are far more complicated than the gasoline and diesel processing processes.

When oil prices rise but base oil price doesn't rise, oil refineries aren't motivated to produce base oil.

Amer's analysts hold that only after supply exceeds demand can the price drop! A fall in oil prices depends on the following four core factors:

1. Iran's crude oil production growth may exceed expectation?

2. U.S. shale oil production may grow strongly?

3. The production increases due to competition for market share within OPEC countries?

4. China's failure to fight the epidemic leads to a sharp decrease in crude oil demand?

But for now, the above four possibilities are impossible!

In the first half of 2022, oil price will continue to rise and remain at highs.

06

How do production enterprises deal with rise of the oil price?

The rise in price of lubricating oil certainly will increase the cost of enterprises.

Lubricating oil, the blood of the machine, serves to protect the movable friction parts of the mechanical equipment and directly affects the life,

precision and product quality of the machinery equipment! Selecting high-quality lubricating oil is things we take for granted in good production management.

With numerous brands of lubricating oil of very different quality, the replacement of new brand models requires rigorous testing and long-term verification process.

The proportion of procurement cost of lubricating oil to the total procurement cost is the minimal, generally no more than 0.2%, and no more than 0.1% for heavy industries such as steel and cement;

Cost savings have greater value than the lubricant savings.

Lubricating oil of different brands can't be mixed, as chemical reactions, oil deterioration and even mechanical failures are easily caused.

If the original lubricating oil that has not expired is scrapped in advance and replaced with cheaper lubricating oil, not only hazardous waste disposal expenses are generated,

but also the discarded materials in advance are lost, so the loss outweighs the gain compared with the cost savings of lubricating oil price itself.

To reduce the impact of rise in price, production enterprises are recommended to:

1. Purchase lubricating oil filtration equipment.

2. Use lubricating oil with longer life and better performance and extend replacement period.

3. Use lubricating oil filtration and purification services and extend replacement period to ensure stable oil quality.

Đề xuất đọc

- 1Sơn chống ăn mòn một thành phần gốc nước WP400M của Amer, khả năng chống phun muối 168-480 giờ, có thể tùy chỉnh, bảo vệ lâu dài cho kim loại trong nhà!

- 2Cracking down on counterfeit goods on March 15 | More than 20 events were reported in half a year, with the amount of money involved in events of nearly RMB 3 billion. How can you not be tricked when purchasing the engine oil?

- 3Deep analysis | Keep soaring? The rise or fall trend of prices of China's lubricating oil in the first half of 2022?

-

Từ khóa nóng